Deal Killer #1: Why “Back-of-the-Napkin” Accounts Scare Buyers Away

You’ve done the hard part. You’ve built a successful business, found a serious buyer, and the Heads of Terms (HoT) are signed. The champagne is on ice, and you’re mentally already on the beach.

Then, the buyer’s forensic accountants arrive.

Within two weeks, the deal stalls. The price is being “chipped” (reduced), or worse, the buyer pulls out entirely. Why? Because the numbers on the page didn’t match the reality of the bank account.

In the M&A world, we call this “The Financial Fog.” It is the single most common reason business sales collapse during due diligence.

At Dexterity Partners, we’ve see this happen time and again with sellers who go to market unprepared. The good news? It is entirely preventable. Here is how to clear the fog and protect your exit value.

The Conflict: Tax Efficiency vs. Sale Value

First, let’s be clear: We don’t blame you for this.

For years, your accountant has likely had a directive: “Legally minimize my corporation tax.”

You’ve run the business to show as little profit as legally possible. You’ve expensed what you can and invested heavily to reduce your liability. That is smart business ownership.

However, when you decide to sell, the goalposts shift 180 degrees. A buyer doesn’t care about your tax bill; they care about your Maintainable Earnings (usually measured as EBITDA). They want to see maximum profit to justify the price they are paying.

This transition from “hiding” profit for tax purposes to “showing” profit for valuation, is where the chaos begins. If you try to make this switch during due diligence, you will look disorganized or, worse, dishonest.

The “Add-Back” Minefield

To bridge the gap between your tax returns and your true profitability, we use “Add-Backs.” These are costs that strictly relate to your current ownership and would not be incurred by a new buyer.

When done correctly, add-backs significantly increase your business’s value. When done poorly, they kill trust instantly.

We often see business owners treating the company checkbook like a personal wallet. While this is common in owner-managed businesses (SMEs), it becomes a nightmare during a sale.

Common Red Flags That Scare Buyers

The Family Payroll: Paying your spouse or children a salary when they have no active role in the business.

The “Company” Fleet: Leasing luxury cars for family members or fueling vehicles that never visit a client site.

Lifestyle Expenses: Putting family holidays through as “business trips,” or expensing personal mobile phones, home broadband, and subscriptions.

Personal Spending: We’ve seen everything from grocery bills to garden renovations buried in “Office Repairs.”

Why This Kills the Deal

You might think, “I’ll just tell the buyer that £20k was for my holiday, and we can add it back to the profit.”

But the buyer thinks: “If they were willing to hide a personal holiday in the P&L, what else are they hiding? Are the sales figures real? Is the stock count accurate?”

Once trust is fractured, the buyer’s risk radar goes up. They will dig deeper, drag out the process, and eventually look for a reason to lower the price to cover their risk.

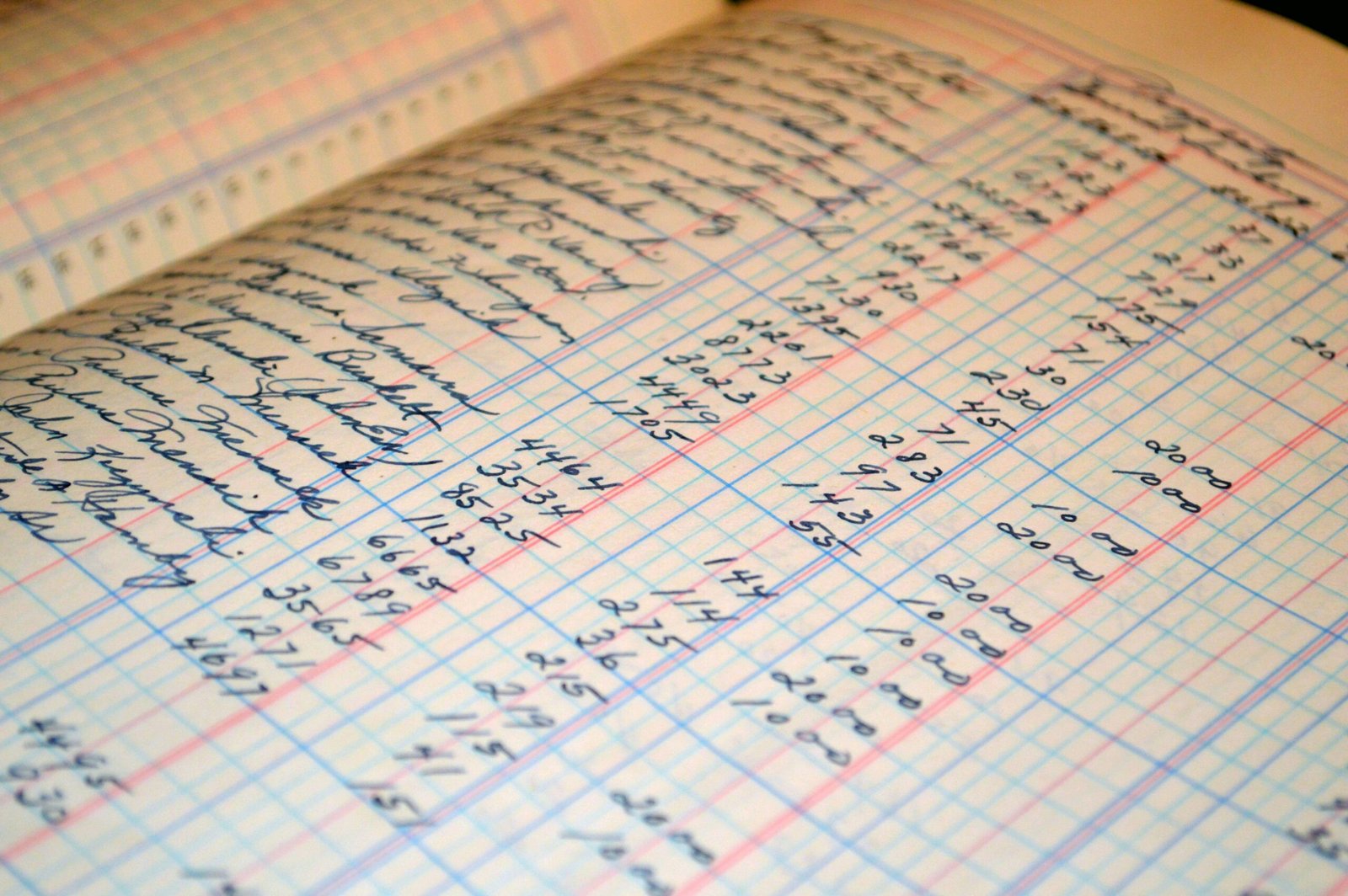

The Danger of “messy” Management Accounts

Another major deal killer is the gap between what you think you are making month-to-month and what your statutory year-end accounts say.

Many business owners run their company by the bank balance. If there is cash, they spend it. They view monthly management accounts as a bureaucratic box-ticking exercise, often leaving them riddled with errors or misallocations.

Imagine this scenario…

You provide the buyer with management accounts showing £500k profit for the year. Based on this, they offer you a 4x multiple (£2m).

Three months later, your accountant finalizes the statutory year-end figures, and the actual profit is £420k because of missed accruals or unrecorded liabilities.

You have just accidentally overpriced your business by £320k.

The buyer won’t just reduce the price by that amount; they may walk away entirely because they feel misled. Consistent, accurate monthly reporting is not just good housekeeping; it’s your main defense during a sale.

The Dexterity Approach: Clear the Fog Before You Sell

This is why we advocate so strongly for the Fit to Sell mindset. You cannot wait until the Heads of Terms are signed to start organizing your financials.

At Dexterity Partners, we act as the filter between you and the market. We don’t just take your numbers and put them in a brochure; we challenge them first.

Our Preparation Process

The Financial Health Check: We review your management accounts against your statutory filings to ensure they align. If there are discrepancies, we fix them now, not when a buyer is watching.

Defensible Add-Backs: We go through your expenses line-by-line. If you want to add back a cost, we ensure there is an audit trail to prove it. We turn “messy expenses” into a clear, defensible “Adjusted EBITDA” schedule that stands up to scrutiny.

The Data Room: We build a secure, organized repository of your financial history. When a buyer asks a question, we have the answer ready immediately. Speed builds trust.

What is the summary? Preparation Pays

Selling your business is likely the biggest financial transaction of your life. You wouldn’t sell your house with a hole in the roof and hope the surveyor doesn’t notice. You shouldn’t sell your business with holes in your accounts either.

By engaging with a corporate finance advisor early, ideally 12 to 24 months before you plan to exit, you can transition your financial reporting from “Tax Efficiency” mode to “Sale Ready” mode smoothly.

The Key Takeaway: Buyers pay a premium for clarity. Uncertainty requires a discount.

If you are thinking about selling in the next few years, don’t wait for a buyer to find the skeletons in your closet. Let’s find them, fix them, and get you Fit to Sell.

FAQ’s

1. Why do business sales fail during financial due diligence?

Business sales most often fail during business sale due diligence because of unresolved financial due diligence issues. In many cases, inconsistent management accounts, unclear EBITDA calculations, or undocumented add-backs create uncertainty for buyers. These risks are one of the leading causes of M&A deal failure, as buyers will either reduce the offer or walk away entirely.

2. What are EBITDA add-backs and why do buyers scrutinise them?

EBITDA add-backs are costs removed from reported profits to calculate adjusted EBITDA, reflecting the true maintainable earnings of the business. Buyers closely examine business valuation add backs because unsupported or aggressive claims signal weak financial controls and increase perceived acquisition risk, often leading to price chipping.

3. How does tax efficiency reduce the value of a business when selling?

The conflict between tax efficiency vs valuation is a major challenge when selling a business. While tax planning reduces corporation tax, it often suppresses reported profits and EBITDA. Without early restructuring, tax-efficient accounting can prevent owners from being able to maximise business sale value in an M&A transaction.

4. What financial red flags scare buyers during due diligence?

Buyers are alert to due diligence red flags such as family members on payroll without active roles, personal expenses in the P&L, or lifestyle costs hidden as business expenses. These M&A red flags are considered serious business sale warning signs because they undermine trust and raise concerns about the reliability of the reported financials.

5. Why do messy management accounts kill M&A deals?

Inaccurate or poorly maintained management accounts in M&A transactions frequently lead to deal failure. Inaccurate financial reporting—especially when management accounts don’t align with statutory filings—signals poor governance. Clean, consistent reporting is essential to effective business sale preparation and protecting valuation.

6. What are Maintainable Earnings and why do they matter to buyers?

Maintainable earnings represent the sustainable profit a buyer expects post-acquisition. Buyers apply an EBITDA valuation multiple to this figure to determine price, meaning any uncertainty directly reduces business valuation EBITDA and increases the risk of renegotiation during due diligence.

7. How far in advance should I prepare my business for sale?

Owners should prepare their business for sale at least 12–24 months in advance. A realistic exit planning timeline allows time to normalise expenses, improve reporting accuracy, and implement a proper sell my business checklist that aligns financial performance with buyer expectations.

8. What is a financial health check before selling a business?

A financial health check for a business sale is a form of pre-sale due diligence (often called vendor due diligence) that identifies discrepancies between management accounts and statutory filings. It ensures that EBITDA, add-backs, and financial disclosures are credible before buyers begin their own due diligence process.

9. Why do buyers reduce the price after Heads of Terms are agreed?

Price chipping in M&A typically occurs after Heads of Terms renegotiation when due diligence uncovers financial inconsistencies or risk. Buyers justify a business sale price reduction to protect themselves from uncertainty—or withdraw if confidence in the numbers collapses.

10. How can a corporate finance advisor increase business sale value?

A corporate finance advisor provides specialist M&A advisory services that prepare defensible financials, structure credible EBITDA add-backs, and manage buyer scrutiny. Engaging an experienced sell my business advisor early increases clarity, reduces risk, and directly improves the final sale price.